Solutions

Our passionate and experienced people deliver successful clean energy projects globally.

Technologies

Driving a clean energy future through state-of-the-art renewable technologies.

See all technologiesResources

Browse our latest resources, including company updates, customer stories, industry insights, and research reports.

See all resourcesCareers

Join a collaborative team of passionate individuals who engage in meaningful, stimulating, and world-changing work.

Learn moreAbout RES

We live our mission, celebrate the people making it happen and transform the way the world produces and consumes energy.

See about usOur offices

Like our business, we’re truly global – but proudly local. Find contact and location details for every RES office.

Contact usPowering the Future: Emerging Trends in Grid-Scale Battery Storage

by RES | Mar 09, 2023 | Reading time: 4 min

By Annette Deveson, Chief Project Officer Australia, RES

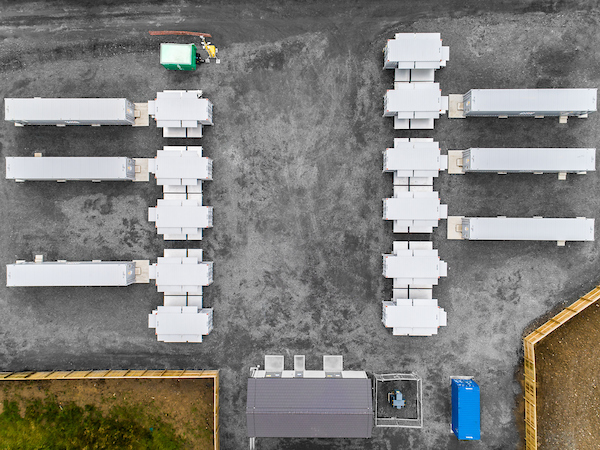

RES was one of the first to enter the battery storage market, driven by the potential of the technology to enable more renewables on the grid and create a smarter energy system. Since then, the Battery Energy Storage Systems (BESS) market has grown. According to a recent report by Statista, the BESS market was estimated at roughly 5.3 billion U.S. dollars in 2021. In this article, Annette Deveson, Chief Project Officer at RES, reviews some of the key upcoming trends.

Driven by the increasing demand for renewable energy, the global battery energy storage market is estimated to be over 10.8 billion dollars by 2026, with the Asia-Pacific region expected to boast the largest battery storage market that year. Providing safety and security for our energy grid, BESS balance the supply and demand of electricity on the grid, reducing our reliance on fossil fuels and facilitate more renewable energy.

Cost effective for grid operators

As with all battery technology, the cost of grid-scale battery storage is decreasing, making it a more economically viable option for grid operators. According to Bloomberg NEF’s annual battery price survey, lithium-ion battery pack prices, which were above $1,200 per kilowatt-hour (kWh) in 2010, fell 89% in real terms to $132/kWh in 2021. 2022 saw the price of lithium-ion batteries increase for the first time in history following events such as COVID 19, delays with production and processing and increased shipping costs. However, it is expected that prices for battery packs will start to drop again in 2024 when lithium prices are expected to ease as more extraction and refining capacity comes online. BNEF’s survey predicts that average pack prices should fall below $100/kWh by 2026, before falling further to just US$62/kWh by 2035.

Longer battery lifetimes

The lifespan of batteries used for grid-scale storage is an important consideration, as they need to be able to provide reliable performance for many years. Battery manufacturers are working to develop batteries with longer lifetimes (including flow batteries) which could provide better long-term performance and reduce the need for frequent replacements.

To date, there has been a relative cost disadvantage of extra storage durations. Furthermore, one hour or less is sufficient to deliver most grid support services, such as frequency response. In the future, we expect more of a project’s’ revenue to be derived from trading energy in the wholesale and balancing markets which will benefit from longer durations. Coupled with declining cell capex this leads us to believe that longer duration systems will become prevalent in the future.

Improved safety and reliability

Safety and reliability are critical factors in grid-scale battery storage. Battery manufacturers are developing new safety features and testing protocols and new technology, including solid-state batteries for improved fire-safety and sodium-ion batteries for improved supply-chain reliability. Insurers are also getting more familiar with storage as the market matures and more datapoints are available, which should help to reduce costs in the longer term as premiums reduce with underwriter confidence.

Advances in technology

Lithium-ion batteries (LIB) are the most mature and dominant technology in the battery storage market and are expected to remain so in the near future. LIB cell chemistries vary, with Lithium Nickel Manganese Cobalt oxide (NMC) and Lithium Iron Phosphate (LFP) being the most dominant form deployed in the market to date. NMC has traditionally offered energy density advantages. However, with LFP being lower cost, improving energy density and available supply chain, it is expected that this will continue to grow its market share.

With the increase in renewable energy sources, it is expected that energy storage technologies will be required with increasing urgency. Public and private investment reflects this, with substantial funding currently directed to the development of non-lithium and long-duration energy storage.

One of the newer technologies in BESS, zinc-hybrid, is expected to emerge as the battery of choice in the renewables market in the medium term, especially when co-located with solar projects. Zinc is widely available and less expensive than the materials used in other batteries.

Redox Flow Batteries (RFB), which use a liquid electrolyte to store energy, are also showing promise as a new medium-term technology for storage. The technology is particularly well-suited for long-duration storage applications, as the energy capacity can be scaled up by increasing the size of the storage tanks. However, flow batteries typically have a higher initial cost in comparison to other batteries, but lifetime costs may ultimately be lower given they are specifically suited for an extremely long life, without the degradation that occurs with lithium-ion and zinc-hybrid batteries.

Moving forward

The market for battery energy storage systems is experiencing an exciting period of growth. With sustained investment in research and development, advancements in manufacturing processes, and capacity expansions throughout the supply chain, battery technology is expected to improve significantly while costs decrease over the next decade.

While grid-scale battery storage has great potential to support a cleaner, more reliable, and more flexible electric grid, there are still some challenges we need to overcome, for instance, regulatory barriers. To fully unlock the benefits of grid-scale battery storage, it is essential for policymakers to address these regulatory obstacles and create a supportive policy environment that fosters innovation, investment, and adoption of these crucial energy storage solutions.

RES currently maintains a significant pipeline of projects and will continue to play a pivotal role in shaping the future of energy storage technology, including lobbying for regulatory change to support BESS advancements across the globe. We will also continue to grow the portfolio of assets we support for third parties, ensuring the ongoing success of battery assets.